On Friday, the Wall Street Journal reported that President Obama's signature financial reform, a Consumer Financial Protection Agency (CFPA), was in trouble in the Senate.

On Friday, the Wall Street Journal reported that President Obama's signature financial reform, a Consumer Financial Protection Agency (CFPA), was in trouble in the Senate.

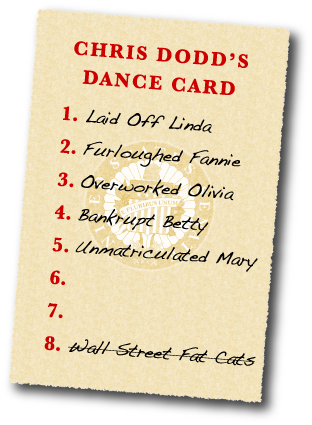

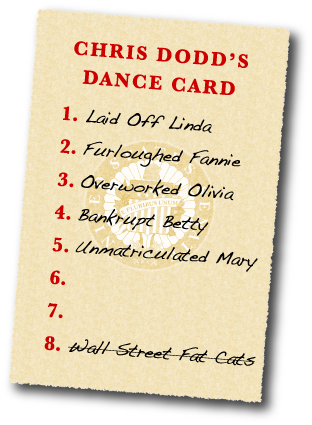

Senate Banking Chairman Chris Dodd (D-Conn.) was considering dropping the idea of creating an independent, stand-alone consumer protection body, empowered to crack down on banking abuses, in order to get a regulatory revamp passed this year with bipartisan support. Dodd is apparently considering shrinking the CFPA into a division of an already-existing federal agency (no doubt one with a proven track-record of failing consumers.)

Dodd is faced with a dilemma. Although he introduced a rather strong financial services reform bill in Congress last year -- one which creates an independent CFPA, curtails the powers of the Federal Reserve and tackles many Wall Street abuses -- it appears that big bank lobbyists who have spent millions fighting reform are now chipping away at his bill.

On Friday, the

On Friday, the